In 2021, we launched our open-source global climate tech taxonomy and our platform tracked over 1,100 climate tech venture deals through the year. We're now tracking hundreds of strategic developments in climate tech, around the world, every week and in this note, we're deep diving venture capital across those 50 clusters to better understand where venture funding is flowing and perhaps more importantly, where it is not.

In the first week of January, we shared our full year analysis of 2021 Global Climate Tech VC, reaching 2.5x pre-pandemic investment levels in 2021, accelerating startups young and older around the world with over $37B of venture funding. Fuelled by a massive US and EU investment surge, Indian investment progressing and China accelerating after moderating from it’s 2018 investment leadership position, 2021 also closed out with 45 ClimateTech Unicorns and 61 Mega Rounds ($100M+) over the prior 12 months.

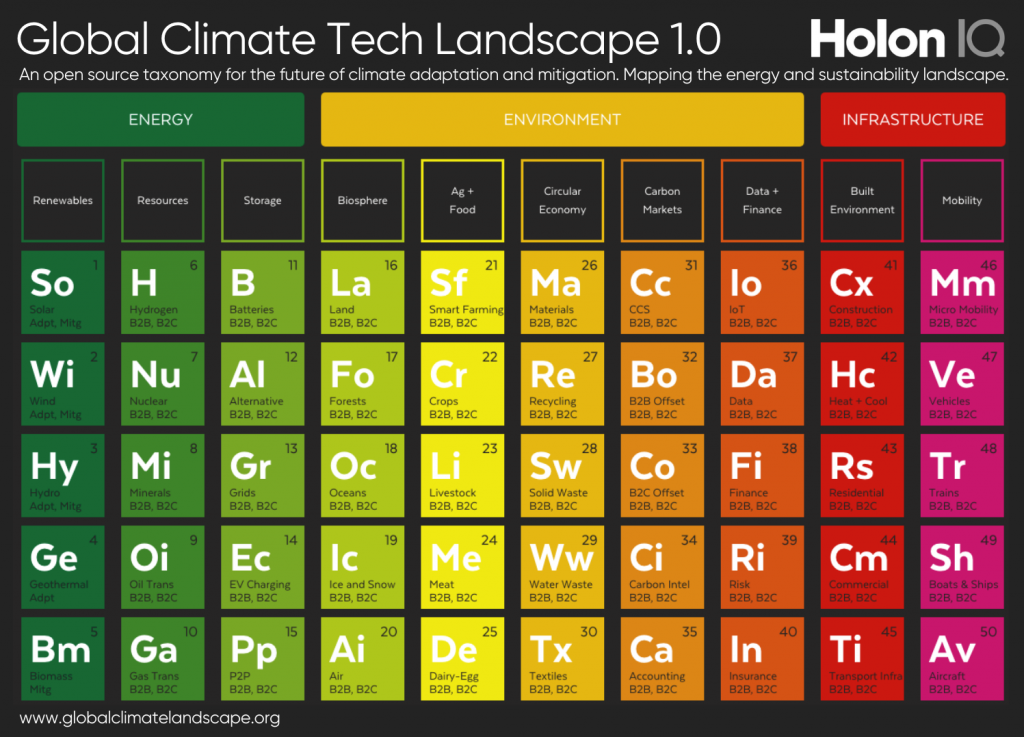

At COP26, we launched the Global Climate Tech Landscape 1.0, an open source taxonomy for the future of climate adaptation and mitigation. And over the prior 100 days (Jul-Oct 2021), we teamed up with regional partners around the world to identify the 1000 most promising Climate Tech startups globally and the 92 women CEOs from the inaugural Climate Tech 1000 (celebrating this inspirational cohort and hoping this spotlight inspires action and support for more women entrepreneurs around the world to lead us towards a cleaner, more sustainable future!).

The purpose of building the Global Climate Tech Landscape is to create a granular and global open-source framework to enable insights such as:

- Where are we seeing solutions and innovation? What is the velocity of formation, funding and growth? How is this changing over time?

- Where are the gaps? When compared to the challenges we are facing, which areas are under-weight or white-space?

- Where are we seeing traction and momentum? Where might new science and technology find a commercial market to apply new novel innovations and achieve self-sustainability?

We are seeing good, albeit slow progress at building consensus around how to segment climate tech and define the boundaries. The typical top-down buckets of Energy, Ag/Food, Mobility and others are aligning, but we need a much more nuanced, focused and granular taxonomy to inform governments, institutions, scientists, entrepreneurs and the impact investment community.

The charts below leverage our open-source prototype, ‘1.0’ Climate Tech Taxonomy to classify the 1,100+ VC deals we tracked through 2021. The left hand stack shows the total capital in USD invested in each of the 10 ‘sub-sectors’ of the taxonomy with critical breakouts that attempt to strategically stratify the landscape, separating vehicles and mobility from infrastructure and charging networks or separating nuclear and hydrogen from the more traditional renewable energy categories.

The centre and right hand charts then break down the near $40B in VC into each of the 50 clusters of the taxonomy. This is where it becomes much clearer where capital was deployed in 2021 but also highlights the strengths and the weaknesses of the taxonomy in relation to venture funding versus private equity, project finance and government sponsored funding. The centre chart shows the sum of all VC through 2021 by cluster and the right hand chart shows the median deal size for the funding rounds in that cluster.