Whether Direct to Consumer (Learner/Parent), Business to Business (School /University /Enterprise) or Hardware vs Software vs Services, COVID initiated dynamic changes in the EdTech spending landscape.

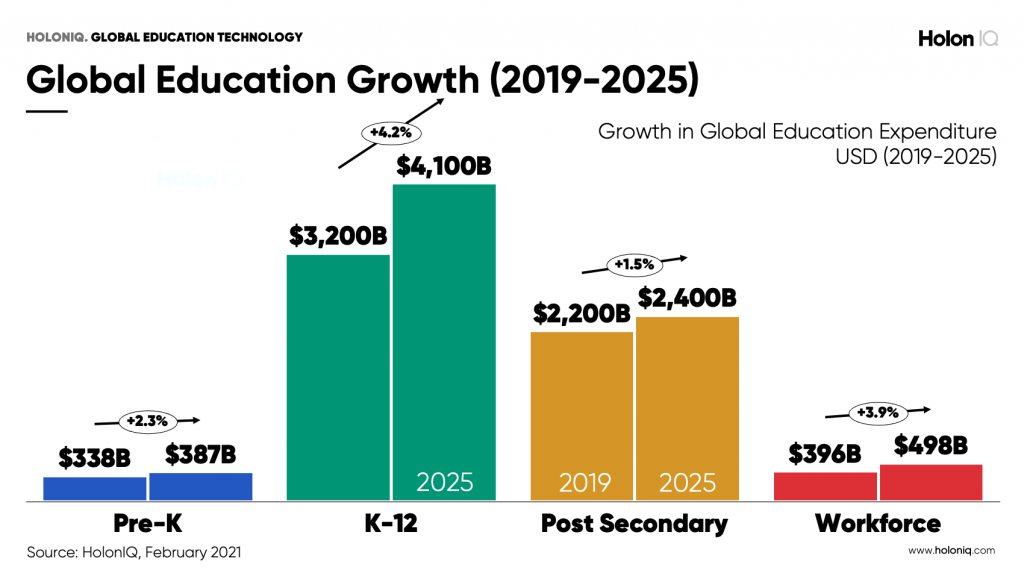

Governments, employers and consumers together will spend over $7T a year on education and training by 2025. Post COVID, we see significant growth in early childhood and workforce education, tuition deflation in higher education and K12 growth driven primarily by emerging markets. The fastest-growing ingredient for the future of education however is very clearly, technology.

While technology has had a limited role in education until recently, in Pre-K, parents are now looking for activities and educational tools and tips to stimulate and accelerate their child’s development. In K-12, schools are aggressively adopting technology to more effectively and efficiently manage their operations, support learners and communicate with parents. Higher Education and the broader post-secondary landscape has had to immediately and abruptly transition to online delivery, as have workforces looking to up-skill and engage their employees remotely.

EdTech is growing at 16.3% and will grow 2.5x from 2019 to 2025, reaching $404B in total global expenditure. Even at this level, EdTech and digital expenditure will only make up 5.5% of the $7.3T global education market by 2025.

HolonIQ’s updated global market size for EdTech is a $63B upgrade to our pre-COVID estimates. We now expect total global EdTech expenditure to reach $404B by 2025 representing a 16.3% CAGR, or 2.5x growth, between 2019-2025.

A short term surge in EdTech spending brought on by COVID-19 is expected to re-calibrate to a longer-term integration of digital technologies and transition to much higher adoption of online education over the coming years. Part of this transition includes a significant ‘infrastructure catch-up’ required for managing learning, data and administration as most schools and colleges are still at the very start of a long digital maturity journey.

In addition to EdTech’s primary role supporting the formal education sector, B2C EdTech models are also on the rise as students, parents and workers increasingly seek learning support and up-skilling for supplemental and/or more direct academic and career outcomes.

Underpinning the transition to digital, for incumbents and new models alike, are broader consumer technology expectations with respect to mobility, personalization, social and gamified learning.